Develop Together : It’s the RDA Way

At RDA we bring a unique, consultancy approach to your Research & Development tax claims.

what is research and development?

R&D Tax Credit Claims Made Simple!

Research & Development (R&D) tax relief is the government’s incentive to reward the time and investment UK businesses have put into solving unusual business problems. It allows firms to claim additional tax savings on many of the costs they incur while developing new products or processes, or improving existing ones.

Invest money in research and development

Make a claim

Reclaim up to

0%

HMRC pays up to 33% of your R&D costs

QUALIFYING REQUIREMENTS

Who qualifies for R&D tax credits?

Any UK-registered limited company, in any industry sector, can apply for R&D tax credits. A successful claim leads to Corporation Tax relief and, for many companies, results in cash remittances from HMRC.

HOW DO YOU QUALIFY FOR R&D?

Is your business eligible for R&D tax credit?

Limited Company

All UK-registered limited companies are eligible under the R&D Tax Credit Scheme. A limited liability partnership (LLP) may only claim if the R&D project is undertaken in partnership with a Corporation Tax-paying firm. Sole traders are ineligible.

Carrying out R&D activities

HMRC set down a complex set of criteria as to what kind of activity qualifies for relief under the R&D Tax Credit Scheme. Fundamentally, the R&D must involve the increase in overall knowledge or capability in a field of science or technology. This means improving on the knowledge that’s publicly available or the capability of a competent professional working in the field.

How your spending qualifies

There is a lot that can qualify for R&D tax relief. This can range from planning, designing, testing and analysis methods through to the creation and adaptation of materials, equipment or software. Even staff time given to things like the record-keeping, maintenance, security protection and training in relation to the R&D project can all count under the R&D Tax Credit Scheme.

Check your eligibility

Find out now if you qualify for R&D tax credit by answering a few simple questions

Step 1 of 4

Is your company registered for Corporation Tax in the UK?

Check how R&D tax credits would work for you

Answer a few quick and simple questions to see where your company is eligible for tax credit.

GREAT REASONS TO CHOOSE US

Why is RDA the company to take care of your claim?

Over £10 Billion of tax relief support given to UK companies since 2000

What we earn from working with you is directly linked to how we perform

Every single one of our clients reports 100% satisfaction with our work

Get in touch

To make a claim leave us a few details and we’ll be in touch

If you would like to give us some background details here before requesting a call back, please do, and of our team will contact you as soon as possible.

- Please selectAerospace and DefenceAlarms/CCTVChemicals, Paints and AdhesiveConstruction and Building MaterialElectronics and ElectricalEngineering and Machinery DesignMaterials, Finishes and ConstructionProjectsSustainabilityPharmaceuticals, Biotechnology and Medical ScienceTesting

Request a call back

Request a call back from our experts

To request a call back at any time, one of our team will respond to you as soon as possible.

- Please selectAerospace and DefenceAlarms/CCTVChemicals, Paints and AdhesiveConstruction and Building MaterialElectronics and ElectricalEngineering and Machinery DesignMaterials, Finishes and ConstructionProjectsSustainabilityPharmaceuticals, Biotechnology and Medical ScienceTesting

WHY IT PAYS TO BE WITH RDA

What makes us different

With RDA

We keep you up to date with government legislation

With our plain-English bulletins, we run through all the latest initiatives for R&D, so you don’t have to. If you want it, we will also provide R&D best-practice coaching and workshops.

Personalised one-to-one approach

Our dedicated Client Managers will work with you to provide an individual, forensic analysis on each project you undertake. We provide a confidential R&D record-keeping service and intellectual-property assessment and advocacy you can call on at any time.

We’ll do all the hard work for you

We also understand that businesses are busy, that time is a valuable asset and our process is designed to take up as little of it as possible. Even so, we are there whenever you need us.

Without RDA

No personalised one-to-one contact

Breaking new ground with R&D is not a straightforward process and how a project is communicated to HMRC is the key to a successful claim. The task requires not only an expert tax agent, but also an expert communicator.

Extensive form fill

Claims under the HMRC Tax Credits Scheme can be complex and laborious to complete, requiring a lot of thresholds to be met. As the company behind the R&D, jumping through all those hoops alone only makes it harder.

No best-practice advice

To understand how best to undertake R&D work, with the methods and processes involved, requires a breadth of experience in dealing with lots of different companies in lots of different sectors. Not every R&D firm or tax agent can say they do.

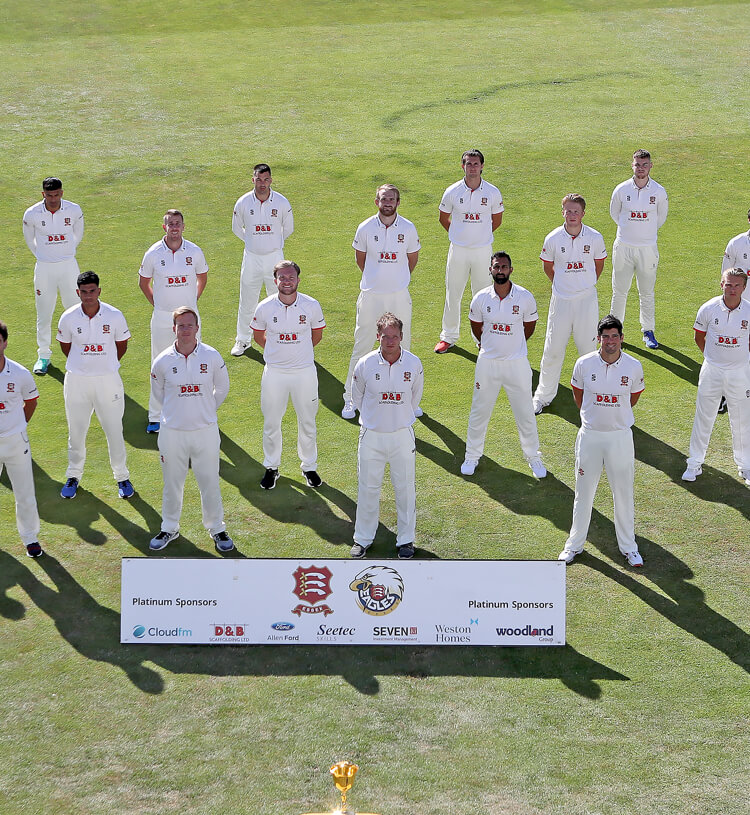

OUR SPONSORSHIP

We’re committed to creating opportunities in the sport and sustainability sectors through our sponsorship partners.

At RDA we love sport – and we find the commitment and discipline of the sports teams and athletes we work with inspirational. That’s why we try to give something back to the sports sector through our sponsorships. We also care deeply about sustainability, which is why we became platinum partners of the Essex Wildlife Trust. Discover more about our motivations.

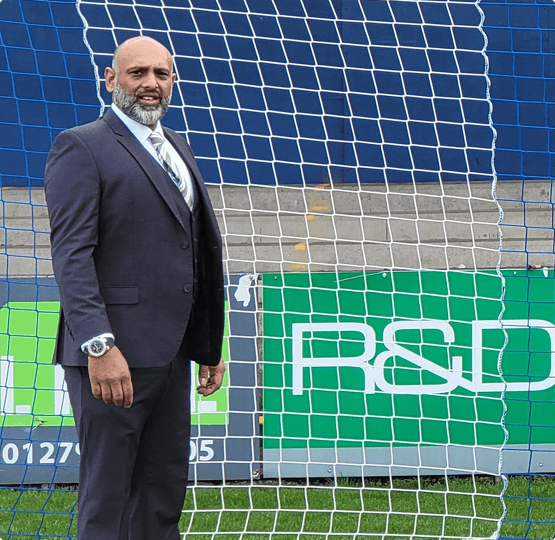

MEET THE TEAM

Get to know us

Hi I'm Kevin Auchoybur,

Managing Director

After 15 years in boardroom positions serving public- and private-sector clients, upon the launch of the HMRC’s large-company RDEC scheme in 2013 Kevin began delivering R&D Tax Credits support for firms across the UK.

CUSTOMER CASE STUDIES

How we’ve helped our clients

Request a call back

Request a call back from our experts

To request a call back at any time, one of our team will respond to you as soon as possible.

- Please selectAerospace and DefenceAlarms/CCTVChemicals, Paints and AdhesiveConstruction and Building MaterialElectronics and ElectricalEngineering and Machinery DesignMaterials, Finishes and ConstructionProjectsSustainabilityPharmaceuticals, Biotechnology and Medical ScienceTesting

Any questions? Talk to our specialists today

Request a call back

To request a call back at any time, one of our team will respond to you within 24 hours

Call us today

Alternatively you can call us and chat to an R&D specialist.

033 33 444 026CLOSES AT 17:00

Request a call back

Request a call back from our experts

To request a call back at any time, one of our team will respond to you as soon as possible.

- Please selectAerospace and DefenceAlarms/CCTVChemicals, Paints and AdhesiveConstruction and Building MaterialElectronics and ElectricalEngineering and Machinery DesignMaterials, Finishes and ConstructionProjectsSustainabilityPharmaceuticals, Biotechnology and Medical ScienceTesting

Get in touch

To make a claim leave us a few details and we’ll be in touch

If you would like to give us some background details here before requesting a call back, please do, and of our team will contact you as soon as possible.

- Please selectAerospace and DefenceAlarms/CCTVChemicals, Paints and AdhesiveConstruction and Building MaterialElectronics and ElectricalEngineering and Machinery DesignMaterials, Finishes and ConstructionProjectsSustainabilityPharmaceuticals, Biotechnology and Medical ScienceTesting